Welcome to the Ultimate Financial Guide.

If you were taught that the path to wealth is "work hard, save money, and retire at 65," you were taught a half-truth that is currently making you poorer.

Before we discuss how to buy a stock, what a ticker symbol is, or how to calculate the fair value of a company (all of which we will cover in this series), we must answer the most important question: Why?

Why should you risk your hard-earned money in the stock market? The answer is simple: Because keeping it in cash is the only guaranteed way to lose it.

Key Takeaways

- The Imperative: You must invest because all currencies are designed to lose value.

- The Data: $1,000 in cash from 1947 is worth $67 today. $1,000 in the S&P 500 is worth $2.1 Million.

- The Hurdle: 10% is the benchmark. It is your "r". Any investment that doesn't aim to beat this is an opportunity lost.

- The Mindset: We aren't looking for "stock prices" to go up; we are looking to own the productive capacity of the world.

- Investing is the only way to ensure that you are not just a passenger in the global economy, but a landlord.

0. The Great Mental Shift

Most people see the stock market as a casino—a flashing green-and-red board where people "bet" on numbers. This is the biggest lie in finance.

In reality, the stock market is a supermarket for businesses. When you buy a share of a stock, you aren't buying a ticker symbol; you are buying a legal claim to the future profits, assets, and labor of a real company. You are hiring thousands of the world's smartest engineers, marketers, and CEOs to work for you.

TIP

The Goal: To move from being a Consumer (someone who gives money to companies) to an Owner (someone who receives money from companies).

1. Breaking the Myth of the "Middle Class"

We often delude ourselves into thinking we are "middle class" because we have a university degree, a nice car, or an office job. But the financial reality is much starker.

If you spend more than 70% of your week working to pay for your lifestyle, you are working class. It does not matter if you wear a blue collar or a white collar; if your life is dedicated exclusively to work and you lack real time for your aspirations, you are in a state of dependency.

Investing is not a luxury for the rich. It is the only tool the working class has to buy back their time and escape this dependency; it is the process of converting your Human Capital (your ability to work) into Financial Capital (assets that work for you). The goal of this guide is to move you from a "Seller of Hours" to an "Owner of Assets."

2. The Silent Tax: Why Savers Are Losers

Most people view a savings account as "safe" and the stock market as "risky." History proves the exact opposite is true.

There is an invisible enemy constantly eating away at your labor: Inflation. It is a silent tax that erodes purchasing power.

To understand why "saving" is a losing strategy, we must look at the history of the US Dollar. Let’s take the case study of a worker in 1947 who had $1,000.

The "Safe" Path (Cash): If that worker put those $1,000 under his mattress in 1947 and he pulled them out today, he would still have $1,000. However, because of the "Silent Tax" of inflation (approximately 3.5% per year), that $1,000 would only buy him about $67 worth of goods in 1947 prices.

The Purchasing Power Loss: In less than 80 years, the currency has lost roughly 93% of its value.

If you just "save," you are essentially a victim of a slow-motion robbery. You are working hard to earn money that is dying by the day. When the price of bread triples, the government hasn't made bread more valuable—they have made your labor less valuable.

3. The S&P 500: The "Average" Decision That Makes You Wealthy

Now, let’s look at the alternative. What if that same worker in 1947 had made the most "average," uninspired investment possible: The S&P 500 (the 500 largest companies in America)?

The Nominal Growth: $1,000 invested in the S&P 500 in 1947, while ignoring the dividends, would be worth approximately $400,000.

The Dividend Factor: If the worker did what if you did what the professionals do—reinvesting every cent of dividends—the worker would have turned those $1,000 into $2,130,000 (even after accounting for the crashes of 1973, 1987, 2000, 2008, and 2020).

The Real Return: Even when we subtract inflation (the 3.5% "Silent Tax"), that $1,000 grew to a purchasing power of $172,000 in 1947 terms.

How does this work? The S&P 500 grows at an average of 10% per year (nominal). This 10% isn't always supported by fundamentals—the actual earnings of the companies—and the market often gets expensive. But the lesson of the last century is clear: over 79 years, a lot can happen, yet not worrying too much about market fluctuations and simply reinvesting the dividends is a pretty decent strategy that anyone can follow ($1,000 → $2.1M).

Why the Stock Market is History's Greatest Wealth Machine

This isn't luck. For over a century, the stock market has been the primary engine for creating millionaires because of Human Ingenuity channeled through compound growth.

At 10% per year, your money doubles every 7 years.

If you put $1,000 in a savings account at 1% for 30 years, you get $1,347.

In the market at 10%? You get $17,449.

Over 79 years? You get $2.1 million.

This is the only way for a regular person to outpace inflation and achieve true financial freedom.

4. Why 10% is the Magic Number (Your Opportunity Cost)

This is where the "flawless" logic of the Ultimate Financial Encyclopedia comes in. Why do we focus on the S&P 500's 10% return? Because it represents your Opportunity Cost.

In finance, every decision is a trade-off. If you can get 10% per year by doing absolutely nothing (passive indexing), then 10% is your "Hurdle Rate."

If your "Financial Advisor" suggests a fund that returns 7%, they are effectively losing you 3% a year.

If you are considering starting a business that only returns 8% on your capital, you are better off closing the doors and buying the index.

This 10% is your "r" (Discount Rate). When we later teach you how to calculate the "Fair Value" of a business using a Discounted Cash Flow (DCF) model, we don't need to hunt for a complex, theoretical "risk-free rate." We use our best alternative. If we can't find a "Wonderful Business" that we are confident will beat the 10% market average, we simply stay in the index.

5. The Pension Trap

"But," you might say, "I have a pension plan."

Most pensions are built on Modern Portfolio Theory (MPT)—what Charlie Munger famously called "dementia." Do not rely on it blindly. Pension funds often over-diversify into low-yield bonds (historically returning around 2-4%). If inflation runs at 3.5%, your pension is technically struggling just to stay even.

Volatility vs. Risk: These funds protect you from the "wiggles" of the stock market (volatility), but they do not protect you from the permanent loss of purchasing power.

The Math of Dependency: Calculations show that $1,000 saved in a standard pension fund (yielding 2% real) since 1947 would be worth only about $320 in real terms today. That is a pittance compared to the $172,000 real terms return of the S&P 500.

Relying solely on state or standard pension plans is a strategy that guarantees a reduction in your standard of living as you age.

6. The Solution: Become an Owner

How do the wealthy escape this trap? They do not hoard cash. They own assets.

While the dollar lost 93% of its value, the S&P 500 (a collection of the 500 largest publicly traded companies in the US) grew by approximately 40,000% (price only) in the same period.

Why? Because companies are productive assets.

When inflation drives prices up, Coca-Cola charges more for its drinks.

When technology advances, Apple sells more efficient phones.

Cash sits there and does nothing. Businesses adapt, grow, and generate cash flow.

Investing is simply the act of shifting your identity from a Consumer (who holds cash that rots) to an Owner (who holds businesses that grow).

7. Our Position: The Path of the Intelligent Investor

As the Ultimate Financial Encyclopedia, our goal is to take you through three levels of mastery:

Level 1: Survival. Understanding that cash is trash and inflation is the enemy.

Level 2: The Lazy Winner. Using the S&P 500 and its 10% return to beat 90% of all professional investors over the long term.

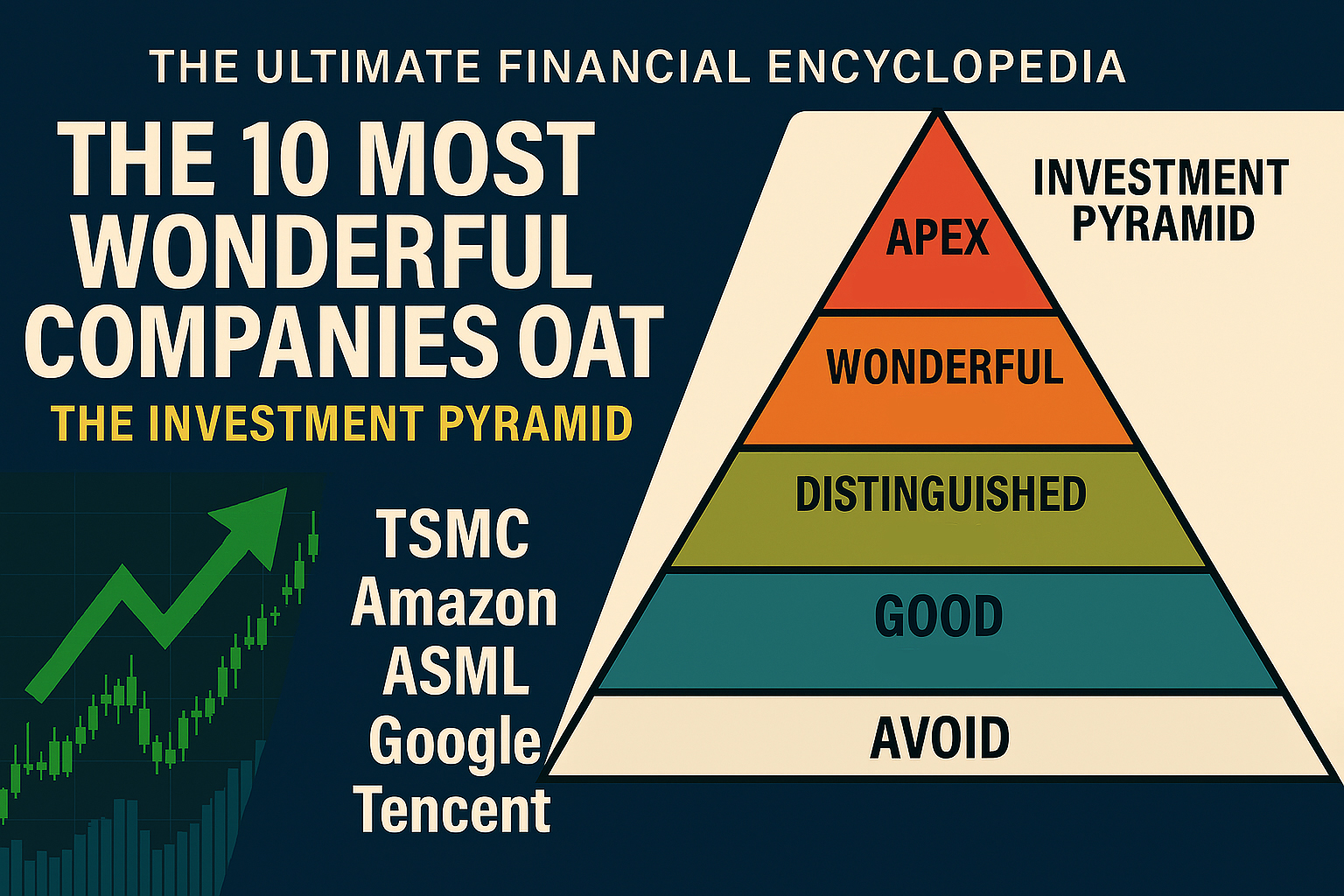

Level 3: The Business Owner. Following the Buffett/Munger path of identifying 3 to 5 Wonderful Businesses that can beat the 10% hurdle because they have high cash flows and "unbreakable" moats.

What Lies Ahead: The Roadmap

You are about to embark on a 12-part journey that will take you from a complete novice to a sophisticated investor. We will not just teach you to "buy the market"; we will teach you to understand value.

Here is the path we will walk together:

Phase 1: The Awakening. You are here. Next, we will learn the philosophy of value (Buffett & Aesop).

Phase 2: The Ecosystem. We will demystify the stock market, tickers, and brokers so you can navigate the arena with confidence.

Phase 3: The Analyst. We will teach you the language of business—how to read financial statements and calculate exactly what a company is worth (Discounted Cash Flow).

Phase 4: The Strategy. We will explore how to build a fortress portfolio, debating the safety of Index Funds vs. the wealth-building potential of "Wonderful Businesses."

Phase 5: Execution. We will open your account, place your trades, and master the psychology required to hold on for decades.

The barrier to entry is not money—you can start with very little. The barrier is knowledge and patience.

Your First Assignment

Before we dive into Phase 1, take a moment to look around your house today. Every brand you see—from the phone in your hand (Apple/Samsung) to the coffee in your mug (Starbucks/Nestlé)—is likely a publicly traded company.

Realize that right now, you are paying them. By the end of this series, they will be paying you.

Turn the page to Part 2. It is time to learn the most important fable in finance: The Bird in the Bush.