Part 7: Passive vs. Active – The Great Debate

Phase 4: The Strategy (Building the Portfolio)

You've come a long way. You understand why investing is imperative (Part 1), you've internalized the philosophy of value over price (Part 2), you've navigated the market's machinery (Part 3), you've built your infrastructure (Part 4), you've learned to read financial statements (Part 5), and you've mastered the DCF model to calculate Fair Value (Part 6).

You now possess the analytical tools that 99% of investors don't have.

But here's the fork in the road, the question that divides the investing world into two camps:

Should you use those skills to pick individual "Wonderful Businesses," or should you simply buy the S&P 500 index and call it a day?

This is the most important strategic decision you'll make as an investor. It will determine:

How much time you spend managing your portfolio

Your potential returns (and potential mistakes)

Your stress level during market crashes

Whether you sleep well at night or obsessively check stock prices

In this part, we'll lay out both paths with brutal honesty. We'll examine the data, the psychology, and the practicality of each approach. By the end, you'll know which strategy fits your personality, lifestyle, and goals.

Let's settle the debate.

The Two Paths: Defining the Players

Path 1: The Passive Investor (Index Fund Strategy)

The Philosophy: "I cannot consistently beat the market, and neither can most professionals. Therefore, I will simply own the entire market and capture its average return."

The Vehicle: An S&P 500 index fund like:

VOO (Vanguard S&P 500 ETF)

SPY (SPDR S&P 500 ETF)

IVV (iShares Core S&P 500 ETF)

The Promise:

~10% average annual return (historical)

Zero research required

Minimal time commitment (set it and forget it)

You beat 90% of professional fund managers over 20+ years

The Trade-off:

You will never beat the market—you ARE the market

You own everything: the winners, the losers, the mediocre

You ride every crash and bubble with no control

Path 2: The Active Investor (Stock Picking Strategy)

The Philosophy: "If I can identify 5-10 Wonderful Businesses trading below their Fair Value, I can beat the market's 10% return while taking on less risk than owning 500 companies."

The Vehicle: A concentrated portfolio of 5-15 individual stocks:

Wonderful Businesses with durable competitive moats (Coca-Cola, Visa, Apple)

Bought with a 30-50% Margin of Safety

Held for decades, not months

The Promise:

Potential to beat the market (12-15%+ annual returns)

You own only businesses you understand and trust

You can sleep through crashes knowing you own quality

The Trade-off:

Requires significant time and skill

You can (and likely will) make costly mistakes

You might underperform the index for years

Psychological warfare: watching your picks lag while the index soars

The Case for Passive Investing: The "Lazy Winner"

Let's start with the overwhelming statistical evidence in favor of passive investing.

The Data is Brutal

SPIVA (S&P Indices vs. Active Funds) Study – 2023 Results:

Over a 15-year period:

92% of large-cap fund managers failed to beat the S&P 500

95% of mid-cap fund managers failed to beat their benchmark

96% of small-cap fund managers failed to beat their benchmark

These aren't amateurs. These are professionals with:

MBA degrees from Harvard and Wharton

Teams of analysts

Billions of dollars in resources

Direct access to company CEOs

And they still lost.

Why? Three reasons:

Fees: The average actively managed fund charges 1-2% per year. The S&P 500 index fund charges 0.03%. Over 30 years, that 1.5% fee difference costs you 40% of your wealth.

Trading Costs: Active managers trade frequently, triggering taxes and transaction costs. Passive investors hold forever, avoiding unnecessary friction.

Human Psychology: Professional managers face career risk. If they underperform for two years, they get fired. So they hug the index, making their portfolios look like closet index funds while charging active fees.

The Math:

Let's say you invest $10,000 and earn 10% per year for 30 years:

Passive (0.03% fee): $174,494

Active (1.5% fee, 10% return before fees = 8.5% after fees): $118,121

The fee difference cost you $56,373.

That's the price of "trying to beat the market."

The Psychological Advantage of Passive Investing

The S&P 500 never makes you feel stupid.

When you own the index, there's no second-guessing:

"Should I have bought Apple instead of Microsoft?"

"Did I sell too early?"

"Why did I buy that terrible stock everyone laughed at?"

There's just: "The market went up 12% this year. I went up 12%. Done."

This psychological simplicity is worth more than people realize. It allows you to:

Ignore the noise: Headlines, tweets, and talking heads become irrelevant

Stay the course: During crashes, you don't panic-sell individual stocks because you "lost faith in the company"

Live your life: You spend zero hours researching, zero hours reading 10-Ks, zero hours agonizing over valuation

The Ultimate Freedom: You set up automatic monthly contributions to your index fund, and you never think about investing again until you retire 30 years later.

The Buffett Bet: Proof in Real-Time

In 2007, Warren Buffett made a $1 million bet:

The Challenge: "I bet that a simple S&P 500 index fund will outperform a basket of hedge funds (run by the 'smartest' people on Wall Street) over 10 years."

The Result (2008-2017):

S&P 500 Index Fund: +125.8% total return

Hedge Fund Portfolio (average of 5 funds): +36.3% total return

Buffett's index fund crushed the professionals by 3.5x.

His conclusion:

"When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds."

Even Buffett—the greatest stock picker in history—tells most people to just buy the index.

When Passive Investing Wins: The Three Scenarios

Passive investing is the superior choice if:

You have limited time: You work full-time, have a family, and don't want investing to become a second job.

You have limited interest: You don't enjoy reading financial statements or analyzing businesses. (And that's okay!)

You want simplicity: You value peace of mind over the possibility of slightly higher returns.

The Bottom Line: If you're not willing to dedicate 5-10 hours per week to studying businesses, just buy the index. There's zero shame in this. You'll beat 90% of professionals and sleep soundly.

The Case for Active Investing: The "Intelligent Investor"

Now let's make the case for stock picking.

The Buffett Paradox

Warren Buffett tells everyone to buy the index. But he doesn't buy the index.

He picks stocks. He's done it for 60 years. And he's generated returns that make the S&P 500 look pedestrian:

Berkshire Hathaway (1965-2023):

Buffett's Return: 19.8% per year (compounded)

S&P 500 Return: 10.2% per year

$10,000 invested in 1965:

In the S&P 500: $2.4 million

In Berkshire Hathaway: $364 million

That's not a typo. 150x better.

So why does Buffett tell people to buy the index if stock picking clearly works?

Because Buffett is honest:

"If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes."

Stock picking works—but only if you do it right. And "doing it right" requires:

Patience

Discipline

Emotional control

A long-term mindset

The willingness to look foolish for years while your strategy plays out

Most people don't have these qualities. So for them, the index is the right choice.

But if you're reading this guide, you're not "most people."

Why Stock Picking Can Win: The Concentration Advantage

The S&P 500 is a popularity contest. It holds 500 companies, including:

~50 great businesses (Apple, Microsoft, Visa, Coca-Cola)

~200 mediocre businesses (barely profitable, no moat)

~250 eventual losers (will be replaced by better companies)

The Drag Effect:

When you own the index, you own all 500. The 50 great businesses carry the weight of the 450 mediocre-to-terrible ones.

The Active Investor's Edge:

You don't have to own all 500. You can cherry-pick the 10 best businesses and avoid the 490 distractions.

Example:

If you had simply bought and held these 5 stocks from 2000-2023:

Apple (AAPL)

Microsoft (MSFT)

Visa (V)

Mastercard (MA)

Costco (COST)

Your return: ~18-20% per year (compounded)

S&P 500 return: ~10% per year

The Math:

$10,000 over 23 years:

S&P 500 (10%): $87,260

5-Stock Portfolio (18%): $340,450

The concentrated portfolio crushed the index by 4x.

But here's the catch: You had to:

Identify these businesses in 2000 (before they became obvious winners)

Hold through the 2000 dot-com crash

Hold through the 2008 financial crisis

Hold through the 2020 pandemic crash

Ignore the noise, ignore the fear, ignore the temptation to sell

That's the price of active investing.

The Moat Advantage: Quality Over Quantity

The S&P 500 owns businesses based on size, not quality. If a company is large enough, it gets added—even if it's a mediocre business.

Active investors can focus exclusively on Wonderful Businesses with:

Durable Competitive Moats:

Network Effects: Visa, Mastercard (every merchant accepts them because every customer has them)

Brand Power: Coca-Cola, Nike (people pay a premium for the logo)

Switching Costs: Microsoft (businesses won't switch from Office/Windows)

Cost Advantages: Costco (scale allows lower prices than competitors)

Predictable Cash Flows:

These businesses print money in recessions and booms alike

High Returns on Capital:

They reinvest profits at 15-25% returns, compounding wealth faster than the market average

The Result: A portfolio of 10 Wonderful Businesses is safer and higher-returning than a portfolio of 500 mixed-quality businesses.

The Tax Advantage: The Silent Wealth Builder

Index funds trigger capital gains taxes every time you rebalance or sell. Even "passive" index funds sometimes have to sell holdings to match the index (when companies get removed from the S&P 500).

Active investors holding individual stocks can:

Never sell: Hold wonderful businesses for 30+ years. Zero capital gains taxes until you sell in retirement (when your tax rate might be lower).

Tax-loss harvest: If one stock drops, sell it for a loss (offsetting gains elsewhere), then buy a similar business to stay invested.

Step-up basis: If you die holding the stocks, your heirs inherit them at the current market value (erasing all capital gains taxes).

Example:

Passive Investor: Sells index fund shares throughout retirement, paying 15-20% capital gains tax on every withdrawal.

Active Investor: Holds individual stocks for life, passes them to heirs with stepped-up basis. Family pays $0 in capital gains.

Over a lifetime, this can save hundreds of thousands of dollars.

When Active Investing Wins: The Three Scenarios

Active investing is the superior choice if:

You enjoy the process: You find reading 10-Ks fascinating, not tedious. You like understanding how businesses work.

You have the time: You can dedicate 5-10 hours per week to research without sacrificing family, career, or health.

You have emotional discipline: You won't panic-sell during crashes. You won't chase hot stocks. You can watch your portfolio drop 30% and sleep soundly because you know your businesses are sound.

The Bottom Line: If you're willing to do the work, active investing can deliver superior returns with less risk than the index—but only if you do it the Buffett/Munger way (concentrated, high-quality, long-term).

The Hybrid Approach: The Best of Both Worlds

Here's the dirty secret: You don't have to choose.

Many intelligent investors use a hybrid strategy:

The 80/20 Portfolio:

80% in the S&P 500 index (your "sleep well at night" foundation)

20% in 5-10 individual stocks (your "beat the market" upside)

Why this works:

The 80% ensures you never fall too far behind: Even if your stock picks fail miserably, the index carries you.

The 20% gives you upside: If your picks outperform, you beat the market. If they don't, you're still fine.

Psychological balance: You satisfy the itch to pick stocks without risking your entire nest egg.

Example:

$100,000 portfolio:

$80,000 in VOO (S&P 500 index)

$20,000 split among 5 stocks (Coca-Cola, Visa, Costco, Apple, Johnson & Johnson)

Scenario 1: Your picks crush it (20% per year)

Index (80%): $80,000 → $130,000 (10% return)

Stocks (20%): $20,000 → $50,000 (20% return)

Total Portfolio: $180,000 (12.5% blended return—beating the market)

Scenario 2: Your picks underperform (5% per year)

Index (80%): $80,000 → $130,000 (10% return)

Stocks (20%): $20,000 → $16,000 (5% return)

Total Portfolio: $146,000 (8% blended return—slightly below market, but not catastrophic)

The Safety Net: Even if you're a terrible stock picker, you still capture 80% of the market's gains.

The Buffett/Munger Filter: How to Pick Without Gambling

If you choose the active path (or the hybrid path), you must follow the Buffett/Munger rules religiously:

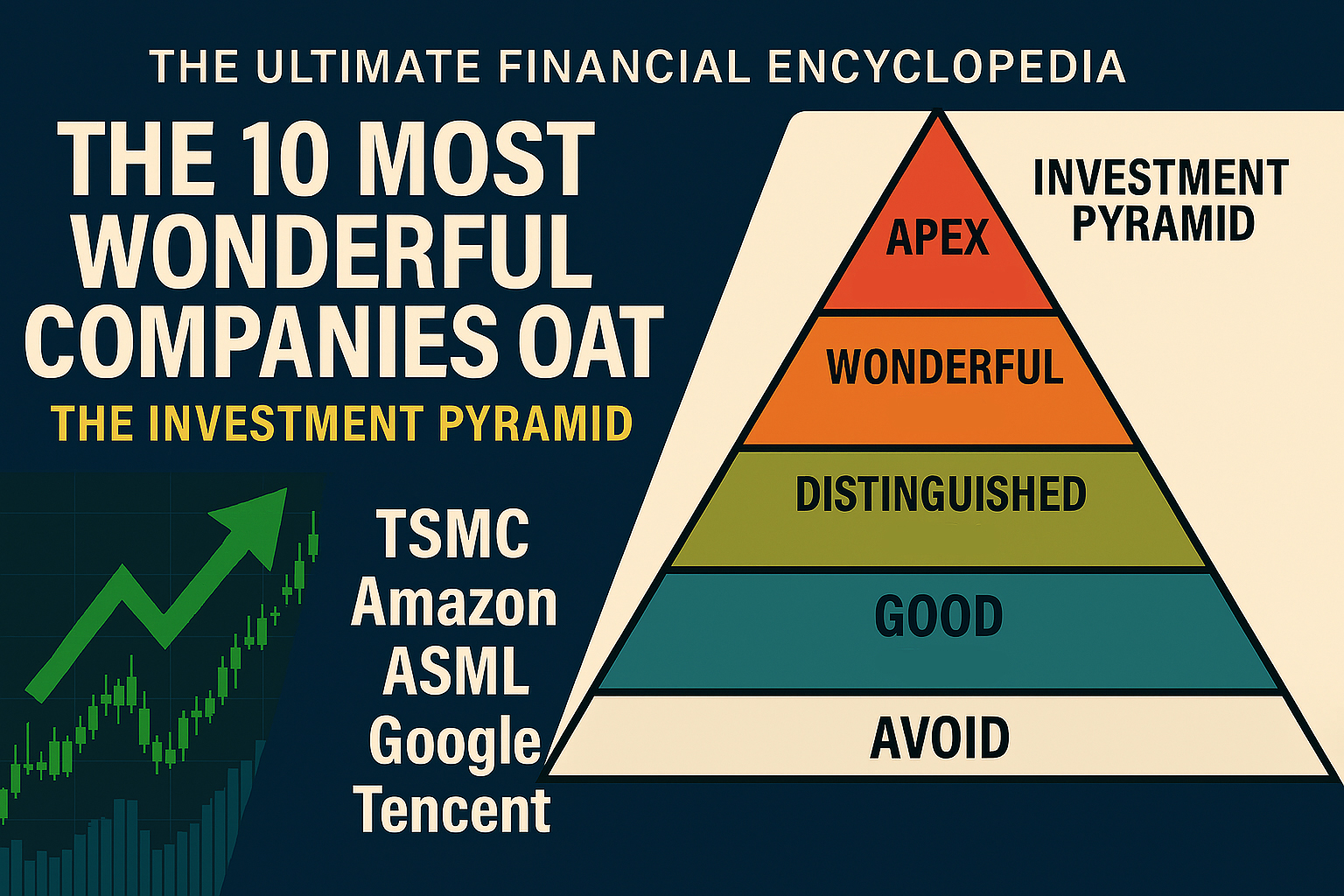

Rule 1: Only Buy Wonderful Businesses

Not "good" businesses. Not "cheap" businesses. Wonderful businesses.

The Checklist:

✅ Durable moat (brand, network effect, switching costs, cost advantage)

✅ Predictable cash flows (consistent FCF growth for 10+ years)

✅ High returns on capital (15%+ ROE or ROIC)

✅ Simple business model (you can explain it in 2 minutes)

✅ Management you trust (capital allocators, not empire builders)

If the business doesn't check all 5 boxes, don't buy it.

Rule 2: Only Buy at a Discount (Margin of Safety)

Even a wonderful business is a terrible investment if you overpay.

The Rule:

Minimum 20% below Fair Value (for ultra-stable businesses)

Ideally 30-40% below Fair Value (for most businesses)

Use the DCF model from Part 6. If the math doesn't scream "BUY," walk away.

Rule 3: Hold for Decades, Not Months

The stock market is a voting machine in the short term. Your wonderful business might lag for 2-3 years while the market chases garbage.

The Discipline:

You're not trading. You're owning.

If the business fundamentals remain strong, price drops are buying opportunities, not sell signals.

Buffett's Test:

"If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes."

Rule 4: Concentrate, Don't Over-Diversify

The S&P 500 owns 500 businesses because it's trying to be average.

You're trying to beat average. That means concentration.

Buffett's Portfolio (Berkshire Hathaway):

~70% of the portfolio is in 5 stocks (Apple, Bank of America, Coca-Cola, American Express, Chevron)

The remaining 30% is spread among ~40 other positions

The Lesson: Your best ideas deserve the most capital.

The Sweet Spot: 5-15 stocks

Fewer than 5: Too much risk (one bad pick devastates you)

More than 15: You're diluting your best ideas with mediocre ones

The Honest Truth: Most People Should Buy the Index

If you've read this far and you're thinking:

"I don't want to read 10-Ks"

"I don't have 5-10 hours per week for this"

"I panic when stocks drop"

"I just want to set it and forget it"

Then buy the index. Seriously.

There is zero shame in this. You will:

Beat 90% of professional investors

Sleep soundly through crashes

Spend your time on things you actually enjoy

Retire wealthy

The S&P 500 is not the "loser's choice." It's the winner's choice for people who are honest with themselves.

The Decision Matrix: Which Path is Right for You?

Choose Passive (Index Funds) if:

✅ You have limited time (less than 5 hours/week for investing)

✅ You have limited interest in analyzing businesses

✅ You value simplicity and peace of mind

✅ You panic easily during market downturns

✅ You want to "set it and forget it"

Your Vehicle: 100% in VOO (S&P 500 ETF)

Your Expected Return: ~10% per year (historical average)

Your Time Commitment: 1 hour per year (annual rebalance)

Choose Active (Stock Picking) if:

✅ You genuinely enjoy analyzing businesses

✅ You can dedicate 5-10 hours/week to research

✅ You have emotional discipline (won't panic-sell)

✅ You can watch your portfolio drop 30% and hold

✅ You're patient (willing to wait years for results)

Your Vehicle: 5-15 individual Wonderful Businesses

Your Expected Return: Potential for 12-15%+ per year (if done correctly)

Your Time Commitment: 5-10 hours per week

Choose Hybrid if:

✅ You want the safety of the index

✅ But you also enjoy picking a few stocks

✅ You're willing to accept that your picks might underperform

✅ You want to "scratch the itch" without risking everything

Your Vehicle: 70-90% index, 10-30% individual stocks

Your Expected Return: Somewhere between 10-13% per year

Your Time Commitment: 2-5 hours per week

Conclusion: There is No "Wrong" Choice

The investing world loves to create false dichotomies:

"Active vs. Passive"

"Growth vs. Value"

"Index Funds vs. Stock Picking"

The truth: Both paths lead to wealth if executed properly.

The Passive Investor builds wealth through simplicity, patience, and capturing the market's average return—which happens to beat 90% of professionals.

The Active Investor builds wealth through concentration, discipline, and the willingness to do the work that most people won't.

The Hybrid Investor builds wealth through balance, combining the safety of the index with the upside of selective stock picking.

The only losing strategy is:

Trying to time the market

Chasing hot stocks

Panic-selling during crashes

Paying high fees for mediocre performance

Trading frequently (turning investing into gambling)

Your Job: Choose the path that fits your personality, lifestyle, and temperament. Then execute it with discipline for decades.

In Part 8, we'll dive into the next critical topic: Building the Fortress – Asset Allocation. We'll explore how to mix stocks, bonds, and cash based on your age, risk tolerance, and goals. We'll also examine Buffett's famous "cash position" and when it makes sense to sit on the sidelines.

The strategy is set. Now we build the fortress.

Let's turn the page.