In the world of finance, there are few words that sound as good to an investor's ear as "dividend." But what does it actually mean? In essence, dividends are the most direct way a company shares its success with its shareholders. They are a fundamental pillar for many investment strategies and a key metric for evaluating a company's financial health and maturity.

This article explores in depth the concept of dividends, how they work, the different types that exist, and, most importantly, how they can influence your investment decisions and portfolio composition. Whether you are looking for passive income or simply want to understand the market better, this term is crucial.

What Is a Dividend?

A dividend is the distribution of a portion of a company's earnings to its shareholders. Imagine you own a piece of a very successful bakery. At the end of the year, after paying all expenses and reinvesting what is necessary for growth, the bakery has a profit. If the owners decide that part of that profit will be shared among everyone, the amount you receive is the dividend.

In the context of the Stock Market, a dividend is a reward to the shareholder for owning a part of the company. The company's Board of Directors is responsible for proposing if dividends will be paid and in what amount, and this decision must be ratified by the General Shareholders' Meeting. Not all companies pay dividends. Young, fast-growing companies, for example, often choose to reinvest all of their profits to fund expansion rather than distributing them. In the long term, this reinvestment is expected to translate into an increase in the share price, which also benefits the investor.

How Do Dividends Work?

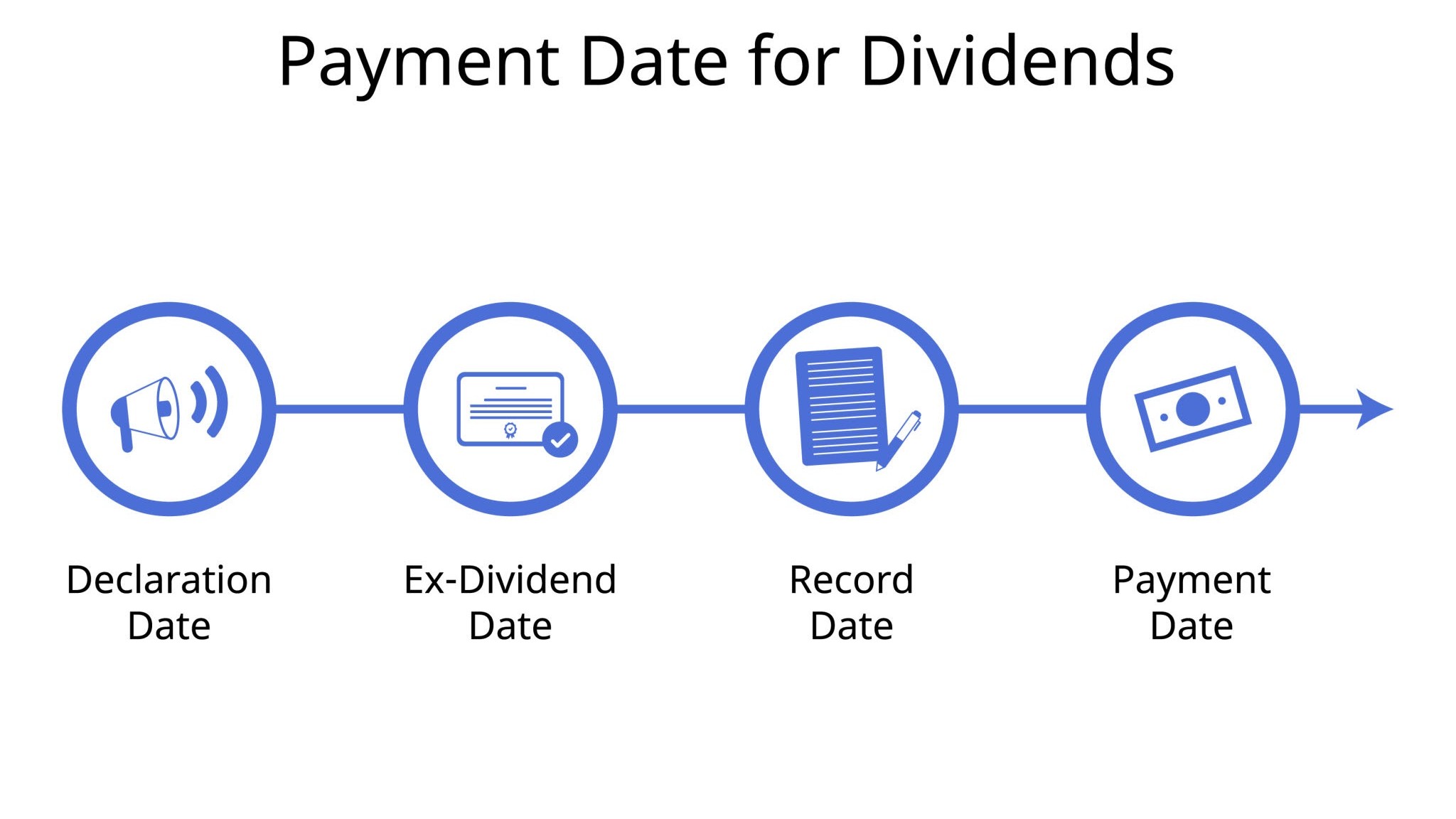

The process of paying dividends, though it may seem simple, involves several important steps and dates that every investor should know.

Declaration Date: The company's Board of Directors publicly declares its intention to pay a dividend and specifies the amount per share. This is the first signal to the market.

Record Date: This is the date on which the company determines who its official shareholders are who are entitled to receive the dividend. It is an internal administrative date.

Ex-dividend Date: This is the most important day for the investor. It is the date from which the stock trades on the exchange without the right to receive the announced dividend. If you buy the stock on this date or after, you will not receive the dividend. If you buy it before, you will. For this reason, the stock price tends to drop on the ex-dividend date by an amount similar to the value of the dividend.

Payment Date: This is the day on which the dividend money or shares are actually transferred to the investors' accounts.

The operation is based on each company's dividend policy. Some, known as "growth" companies, do not pay dividends. Others, called "value" or "income" companies, have a long history of stable and even growing payments. Finally, some pay residual dividends, meaning only what is left after financing all necessary investments for the business.

A key concept is the Dividend Yield, which is calculated by dividing the annual dividend by the current share price and is expressed as a percentage. For example, if a $100 stock pays an annual dividend of $5, its yield is 5%. This metric is very useful for comparing dividend performance between different companies.

Examples of Dividends

Dividends are not always paid in the same way. There are several types, each with its own implications.

1. Cash Dividend: This is the most common form. The investor receives an amount of money for each share they own, which is deposited directly into their brokerage account.

Example: The company "Healthy Foods Inc." announces a dividend of $0.25 per share. If an investor owns 1,000 shares, they will receive $250 in cash.

2. Stock Dividend (or Scrip Dividend): The company does not pay in cash but issues new shares that it gives to its shareholders. This modality is advantageous for the company because it allows it to keep its cash for other investments. For the investor, it can be a way to increase their stake in the company.

Example: "Future Tech" announces a dividend of 1 share for every 20 owned. If you have 1,000 shares, you will receive 50 additional shares. Although the value of each share might adjust downward due to dilution (the increase in the total number of shares), in the long term, your stake in the company is larger.

3. Interim and Final Dividend: It is common practice for a company to pay a partial dividend during the year ("interim") and, once the final results are known, pay the rest ("final").

4. Special Dividend: This is paid outside of the regular dividend policy. It usually happens when a company has an exceptional profit, such as the sale of one of its divisions or a major asset.

Example: A telecommunications company sells a high-voltage tower for a much higher price than expected. The Board of Directors decides to use part of that gain to pay a special dividend to its shareholders as a sign of good faith and to reward their loyalty.

Benefits and Disadvantages of Dividends

Investing in companies that pay dividends has its pros and cons. The decision to focus on this type of stock depends on each investor's financial goals.

Benefits

Regular Passive Income: Dividends provide a constant and predictable source of income, which is especially attractive for retired investors or those looking for cash flow to supplement their finances.

Signal of Financial Stability: A company that pays dividends consistently and, better yet, increases them over time, sends a message of strength and confidence to the market. It indicates that management is confident in future profits.

Protection Against Volatility: In bear markets, stocks with good dividends tend to be more resilient, as investors seek the security of the income they offer. The dividend can mitigate capital losses if the share price falls.

Compound Interest Effect: If you reinvest dividends to buy more shares, over time you can generate exponential growth in your investment. The dividends you receive from your new shares are added to those you already had, creating a powerful virtuous cycle.

Disadvantages

Opportunity Cost: The money a company allocates to dividends is money that is not reinvested in the growth of the business. If a company with high growth potential pays dividends, it could be slowing down its own expansion.

Taxation: Dividends are usually subject to taxes, often at the same time they are paid. This reduces the net amount you receive. In some countries, this double taxation (first at the company level and then at the shareholder level) can be an important factor.

Risk of Cut or Cancellation: A company can reduce or suspend dividend payments if it faces financial difficulties or if it needs capital for an urgent investment. A dividend cut is seen as a very negative signal by the market and can cause a sharp drop in the stock price.

Loss of Share Value: On the ex-dividend date, the share price drops by an amount equivalent to the dividend paid. It is a natural accounting adjustment, but it can create the impression that value has been lost immediately.

Questions and Answers (FAQs)

Q: What is the "ex-dividend date" and why is it so important? A: The ex-dividend date is the deadline to own a stock to be entitled to receive the next announced dividend. For the investor, it is crucial because if they buy the stock on or after that date, they will not receive the dividend. Conversely, if they sell it on or after that date, they will still receive the dividend.

Q: Do all companies on the stock exchange pay dividends? A: No, many companies, especially high-growth ones like young tech firms, choose to reinvest 100% of their earnings to fund their expansion. Their primary goal is the long-term appreciation of the share price.

Q: Is it better to invest in companies that pay dividends or those that don't? A: It depends on your goal. If you are looking for a steady stream of income, dividend investing is ideal. If your goal is aggressive long-term capital growth and you don't need the income, companies that reinvest their profits may be a better option. It's a matter of personal strategy and life stage.

Q: What is the payout ratio? A: The payout ratio is the percentage of net earnings that a company allocates to paying dividends. It is calculated by dividing the dividend per share by the earnings per share. A ratio of, for example, 60% indicates that the company distributes 60% of its profits and retains the remaining 40% for reinvestment. A ratio that is too high (close to 100%) can be a warning sign, as it might indicate the company doesn't have enough capital for growth.

Conclusion: The Bottom Line

Dividends are more than just a simple income; they are one of the most powerful and attractive tools for long-term wealth building. They offer insight into a company's financial health and can provide a very valuable stream of passive income for the investor.

However, it is vital to remember that they are not a guaranteed payment. The decision to invest in dividend-paying companies should be based on a careful analysis of the company, its history of payments, and its ability to maintain them in the future. Understanding how dividends work, from key dates to different types of payments, will allow you to make more informed investment decisions and align your strategy with your financial goals.

In the investment world, dividends are the reward for ownership and, when managed wisely, can become a fundamental engine for the prosperity of your portfolio.